inheritance tax rate colorado

First estate taxes are only paid by the estate. When it comes to federal tax law.

Colorado Estate Tax Do I Need To Worry Brestel Bucar

The following are the federal estate tax exemptions for 2022.

. However Colorado residents still need to understand federal estate tax laws. After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes. Answered in 6 minutes by.

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. It is the most efficient. Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets.

In 2022 Connecticut estate taxes will range from 116 to 12. Connecticuts estate tax will have a flat rate of 12 percent by 2023. A state inheritance tax was enacted in Colorado in 1927.

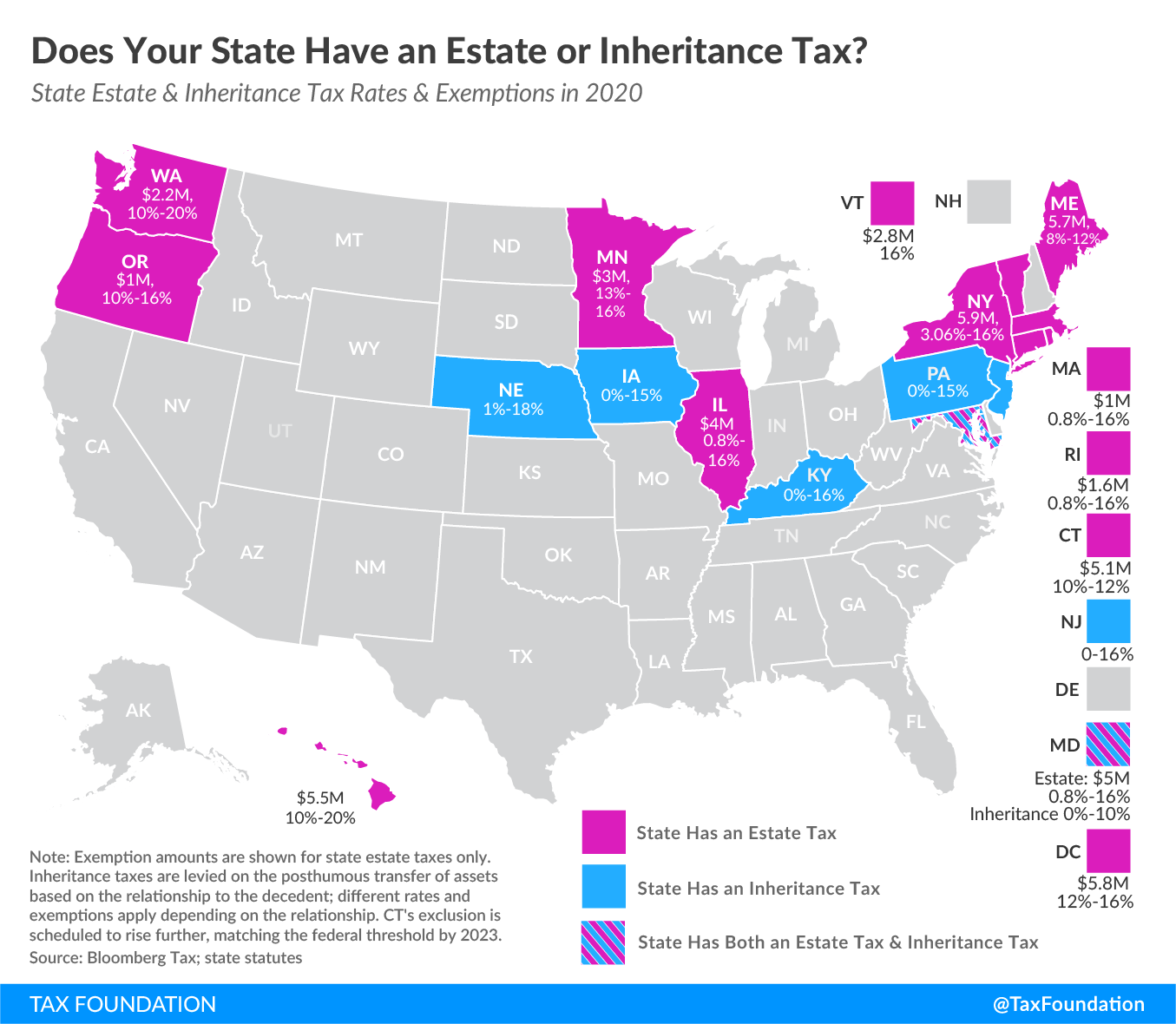

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Colorado Capital Gains Tax. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The 29 state sales tax rate only applies to medical marijuana. The federal gift tax exemption is.

The state and average local sales tax rate is 539. In 2021 this amount was 15000 and in 2022 this amount is 16000. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. What is the colorado inheritance tax rate.

There is no estate or inheritance tax in Colorado. In Pennsylvania for instance if a parent inherits property from a child age 21 or younger the inheritance tax rate is 0. The 2022 state personal income tax brackets.

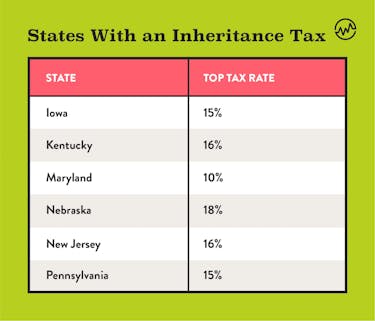

Until 2005 a tax credit was allowed for federal estate. 2022 state levies on estates inheritances or both. Twelve states and the district of columbia impose estate taxes and six.

Inheritance Tax Rate Colorado. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Colorado also has no gift tax.

The good news is that since 1980. Ask Your Own Tax Question. Federal Estate Tax Exemptions For 2022.

There is no estate or inheritance tax collected by the state. It means that anyone can make up to 16000 for gifts to as many people every year. In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere.

If it does its up to. Individuals can exempt up to 117 million. Nevertheless the Federal Gift Tax has an annual exclusion amount of 16000.

Maryland is the lone state that levies both an inheritance tax and an estate tax. Married couples can exempt up to 234.

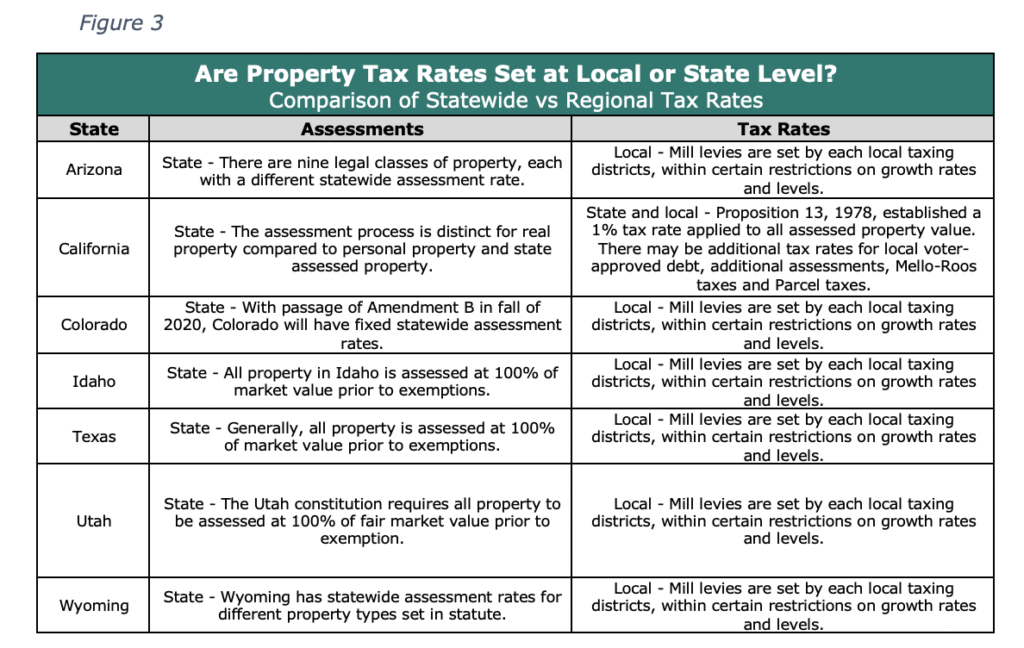

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

How To Sell An Inherited Home Wholesale Real Estate Real Estate Articles Selling House

Inheritance Tax Here S Who Pays And In Which States Bankrate

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Colorado Estate Tax Everything You Need To Know Smartasset

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Ira

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Next Chapter Property Solutions Can Buy Your House In The Situation When You Want To Sell Your House For Some Reasons We Buy Houses Sale House Reverse Mortgage

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Don T Die In Nebraska How The County Inheritance Tax Works

Infographic Financial Inclusion For East Africa Financial Inclusion Financial Infographic